The Exponential Curve

Is it a sign that Jesus is returning soon?

By Dr David R. Reagan - Have you noticed that almost everything in life seems to be accelerating? Knowledge has exploded. We are travelling faster and farther than ever before. Instant, worldwide communication has become common place. And the power at our disposal is mind-boggling.

A Sign of the Times

The Bible teaches that this acceleration of life which we are experiencing will be a sign of the end times – a sign that will signal the soon return of the Lord.

Consider Daniel 12:4. In this verse the Lord tells Daniel that one of the signs of the end times will be an acceleration of travel and knowledge. Here’s how the verse reads in the Living Bible paraphrase:

“Daniel, keep this prophecy a secret... Seal it up so that it will not be understood until the end times when travel and education shall be vastly increased.”

The same concept of end time acceleration is found in the New Testament. Jesus spoke about it when He talked with His disciples about the signs of the end times that would herald His return (Matthew 24:5). He mentioned a great variety of signs – spiritual, natural, societal and world political – and then He said these signs would be like “birth pangs (Matthew 24:8).”

Any mother knows that as the birth of a baby approaches, the birth pangs increase two ways. The increase in frequency and intensity. Thus, Jesus was saying that the closer we get to the time of His return, the more frequent and intense the signs will become. There will be more earthquakes and more intense ones. Likewise things like famine, pestilence and war will increase in frequency and intensity.

The Mathematical Concept

In mathematics this acceleration is called an “exponential curve.” This term comes from what happens when rapid growth is plotted on a chart. When graphing the growth or decline of anything, the rate of change becomes exponential when it starts increasing or decreasing so fast that the plot line becomes vertical. Now, the point is that the Bible indicates that the exponential curve will be one of the signs of the end times, and my thesis is that we are living in the midst of the exponential curve. There for, we are living in the end times.

Examples of the Curve

The 20th Century was the century of the exponential curve. Let’s consider some examples.

1. Population – Demographers estimate that the population of the world at the time of Jesus was only 200 million. It took 1650 years for the world’s population to double! But thereafter it began to double very rapidly because the Industrial Revolution produced modern medicine, which, in turn, reduced infant mortality rates and increased longevity.

As the statistics below indicate, the rate of doubling has now reached exponential proportions.

Time of Christ: 200 million

1650, 1650 years: 400 million

1850, 200 years: 1.3 billion

1950, 100 years: 2.5 billion

1980, 30 years: 4.5 billion

2000, 20 years: 6.0 billion

Again, the key to this phenomenal growth has been modern medicine. Most people do not realize how modern our medicine really is and how radically it has affected our lives. For example, the life expectancy in the United States in 1900 was 47 years. At the end of the 20th Century it was 77 years. That’s an increase of 30 years in life expectancy over a 100-year period of time!

Many health problems today that are considered minor were deadly as recent as the 19th Century – appendicitis being a good example. During the horrible Flu Pandemic of World War 1 (1918-1919) over 40 million people died because the flu usually developed into pneumonia, and there was no guaranteed way for treating pneumonia. That’s because the very first antibiotic, penicillin, was not discovered until 1928.

Life before the 20th Century was short and brutal – often filled with suffering. If you are 35 years of age or older, you have lived longer than the vast majority of humanity. Here’s an amazing fact: Two-thirds of all the people who have lived to the age of 65 are alive today!

2. Knowledge – Another area that is increasing exponentially is knowledge. The prophet Daniel was specifically told that knowledge would vastly increase in the end times (Daniel 12:4), and it has. In fact, we have become so overwhelmed with the flood of new information that it is difficult to find wisdom anymore, because wisdom comes from reflection on knowledge.

It is estimated that 80% of all scientists who have ever lived are alive today. Every minute they add 2000 pages to man’s scientific knowledge, and the scientific material they produce every 24 hours would take one person five years to read.

The scientific journals cannot publish all the academic articles that are being written. Many have to limit the articles to one page abstracts, and even then most articles are rejected for a lack of space.

Consider how rapidly knowledge is increasing:

From Jesus to 1500 it doubled (1500 years)

1500 to 1750 it doubled again (250 years)

1750 to 1900 it doubled again (150 years)

1900 to 1950 it doubled again (50 years)

Today, knowledge is doubling every 12 months!

That means encyclopedias are out of date before they can be printed, which is the reason they are no longer printed. Britannica stopped printing in 2010 after 244 years.

I read recently where a research organization had determined that one Sunday issue of the New York Times contains more information than the normal person in the 19th Century was exposed to in a lifetime!

The most amazing thing to me in the area of information is the Internet. Using it, I can access the documents of the Vatican in seconds, and then in a matter of moments, I can go to the Israel Museum in Jerusalem, or I can dart back to the Library of Congress in Washington, DC. In short, I can access information all over the world without ever leaving my office.

3. Transportation – In 1900 the major means of transportation was what it had always been throughout history – namely, walking and riding a horse. The bicycle had been invented, and the steam engine had been applied to ships and trains. But steam powered transportation was too expensive for most people. Today we have cars and airplanes. We have bullet trains that travel faster than the speed of sound. And then, of course, there are rocket ships that take astronauts into orbit around the earth.

In 1866 Mark Twain travelled to the Holy Land. It took him three months to get there. Today, a group can get on a jet plane in New York and be in Tel Aviv in 13 hours (and most will complain about how long the trip took!).

During the 19th Century, the average number of kilometers travelled per year by a person in the United States was 800. Many lived and died and never got outside the country they were born in! By 1900 the average number of kilometers travelled per year by a person inside the United States had risen to 1600. Today it is 40.000 kilometers per year, and many of us put twice that much mileage on an automobile in a year’s time.

4. Communications – At the beginning of the 20th Century the telegraph had sped up communications considerably, and the telephone had been invented. But the fundamental means which most people used to get information was still the newspaper. Today our communication resources are overwhelming. We have telephones, radio and television. We have exotic devices like fax machines, pagers and cellular phones. And we can communicate worldwide through satellites. I never cease to be amazed when I see someone use a credit card at an Arab shop in the Old City of Jerusalem. The may be nothing but a primitive hole in the wall, but over in some dark corner there will be a machine where the merchant can swipe the card. A few moments later he receives an authorization. During those few moments, the card number has been transmitted to Tel Aviv, from Tel Aviv to New York by satellite, from New York to the credit card processing Centre somewhere in the States, and then back to the Arab shop in Jerusalem!

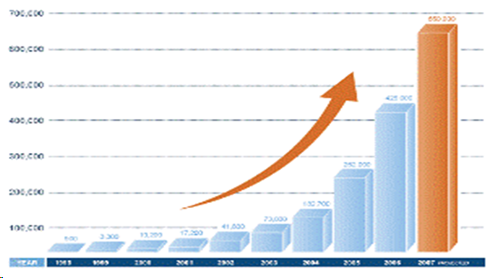

I am equally amazed at the way I can sit down at a computer at my home or office and use the Internet to send a letter in seconds to almost any place in the world. In 1995 when I got on the Internet, there were only 16 million people using it. Three years later, in 1998, there were 150 million. Today there 2.2 billion users worldwide!

Once again, we have the exponential curve.

5. Computers – Computer technology has contributed to the rapid acceleration of many aspects of life, and, of course, the exponential curve applies to the development of computers as well. Anyone who tries to stay on the cutting edge of what is new in computer equipment knows that it is a never-ending battle that requires a lot of money. Advances are so rapid that equipment is out of date within a few months.

In 1970 I was a professor at a college where we bought an IBM computer for $100 000. It operated off punch cards, it was so large that it filled a room, and it generated so much heat that we had to have the room equipped with additional air-conditioning. The computer’s memory was 64K!

Now, if you are not a computer buff, that may not mean much to you, but keep reading because I’m going to make it understandable; and in the process, I’m going to illustrate how rapidly computer technology has developed.

Ten years later in 1980, this ministry bought one of the first desktop computers made. It was a Tandy TRS 80, Model II. It cost $4800 (equivalent to $12 500 today!). When I turned it on, I was astounded by the first thing that appeared on the screen: “64K Memory.” In 10 years we had gone from a computer that weighed more than a ton to one that sat on a desk top, and the price had dropped 95%. But the memory was the same!

Ten years later I bought an electronic Rolodex small enough to fit in the palm of my hand. It cost $90. And when I turned it on, guess what? The first message that appeared on the screen was “64K Memory.”

Today, you can purchase a computer with 4 gigs of memory and a 1 terabyte hard drive operating at 2.7 gigahertz for less than $500!

The exponential curve also applies to data storage units. The first floppy disk that we used in the TRS 80 was 8” in size. It held 300 000 bytes of information. A few years later the 5¼” disk appeared. It would hold 700 000 bytes. Then came the 3½” disk. Its capacity was 1.4 million bytes! The next hottest thing to come along was the CD Rom disk. I recently read an advertisement for a CD that contained 134 000 pages of theological documents – the equivalent of 700 kilograms of books! Today my data storage device of choice is a tiny thumb drive or flash drive that holds 30 gigabytes!

6. Military Power – Throughout most of recorded history, the maximum power at man’s disposal consisted of bows and arrows, spears and catapults. Even at the beginning of this century, war was still primitive. World War 1 turned into a stagnant war of attrition because neither side had sufficient power to break out of the trenches.

Eighty years later, we have air power, armored power, nuclear weapons and sophisticated bacteriological and chemical weapons. We have ICBM’s that can deliver a nuclear payload halfway around the world. We have laser-guided missiles that can guide a bomb down a smoke stack hundreds of kilometers away. And we have nuclear submarines that can circle the globe without surfacing. Incredibly, just one of those subs today has more firepower than all the bombs dropped in World War 2! It is no wonder the Bible says that in the end times “men will faint with fear” over the expectation of “the things which are coming upon the world (Luke 21:26).”

7. Violence – I don’t think I have to emphasize that violence and lawlessness have been increasing. But it is hard to comprehend how rapid the increase was during the 20th Century. It is estimated by experts that the number of people killed in all the wars fought from the time of Jesus until 1900 was 40 million. In the 20th Century 231 million people died in wars, making it a century of unparalleled carnage.

There are currently a total of 38 wars or civil wars raging worldwide. And then, of course, there has been the advent of international terrorism, resulting in the loss of tens of thousands of lives. In 2011 alone there were 10 283 terrorist attacks worldwide.

Within the United States, violent crime increased 430% between 1960 and 2010. During the same period, the country’s population increased only 67%.

8. Society – The disintegration of society has multiplied in speed as violence, wickedness and immortality have increased exponentially. Jesus prophesied this would happen when He said that end time society would be like it was in the days of Noah (Matthew 24:37-39), when violence and immortality prevailed (Genesis 6:11). Paul prophesied about the disintegration of society in 2 Timothy 3:1-5 where he wrote that in the end times people would be lovers of self, lovers of money and lovers of pleasure. The love of self is Humanism, and it is the religion of the world today, masquerading under many different labels. The love of money is Materialism, and money is the god of these times. The love of pleasure is Hedonism, and that is the prevalent lifestyle of today.

But God cannot be mocked or deceived. When a society makes Humanism its religion, Materialism its god and Hedonism its lifestyle, there is always a payoff, and that is Nihilism, or despair. I have witnessed the exponential decaying of society with my own eyes. I was born in 1938. When I was born:

“Abortionists were sent to prison.

“Pregnancy out of wedlock was thought of as scandalous.

“Homosexuality was considered unnatural and immoral.

“Pornography was despised as a perversion.

“Marriage was sacred. Living together was taboo.

“Divorce was a disgrace.

“Homemaking was honored, and daycare was provided by mothers in their homes.

“Child abuse was unheard of.

“Ladies did not curse or smoke.

“”Damn” was considered flagrant language in a movie. (A 1992 film called, Glengarry Glen Ross, had the “f-word” in it 138 times in 100 minutes!)

I could go on and on about the many ways in which our society (and societies around the world) have decided to “call evil good and good evil (Isaiah 5:20).” But the most dramatic way I can think of to illustrate how rapid the deterioration of society has become in America is to consider the results of two polls concerning public school discipline problems, one taken in the 1940s and the other in the 1980s. Both were taken in the Fullerton, California School District. Consider the drastically different results (and weep!):

The Top Public School Discipline Problems

|

Mid-’40s 1) Talking 2) Chewing Gum 3) Making noise 4) Running in halls 5) Out of turn in line 6) Improper clothing 7) Littering |

Mid-‘80s 1) Drug Abuse 2) Alcohol Abuse 3) Pregnancy 4) Suicide 5) Rape 6) Robbery 7) Assault |

9. Natural Disasters – The Bible says that natural disasters will also be increasing exponentially in the end times, and that is exactly what is happening.

Consider these statistics for natural disasters within America between October 1991 and November 2004, a period of 13 years:

9 of the 10 largest insurance events in US history.

5 of the costliest hurricanes in US history.

3 of the 4 largest tornado swarms in US history.

And all that was before Hurricane Katrina in 2005!

Putting together all types of natural disasters worldwide, they are increasing, from an average of 300 per year in the 1980s to almost 1 000 in 2010.

10. The Economy – This brings us to a man-made disaster – namely the out of control spending that has come to characterize the modern welfare state. This is leading to the destruction of our nation. It took over 200 years for our nation’s debt to reach one trillion dollars in 1980. Thirty years later, in 2010, it had soared to $14 trillion. Today (2012), it has just topped $16 trillion. It is increasing at the rate of $75 million per hour. The interest alone is accumulating at the rate of $50 million an hour.

A good way of illustrating the impact of this overwhelming debt is to consider how much it represents per person in the United States. At a Tea Party Rally in 2010, a little girl about 4 years old was seen wearing a sign that said: “I’m already $38 375 in debt, and I only own a doll house!” since that time, our individual share has increased to $51 000.

In short, our nation is bankrupt, and our economy could collapse any minute.

11. World Evangelism – Not all the exponential curves are bad. Modern technology has made it possible for the Gospel to be preached to billions of people through the use of such media as radio, movies, and satellite television.

And, again, this phenomenal development is a fulfillment of Bible prophesies. Jesus Himself said: “This gospel of the kingdom shall be preached in the whole world for a witness to all the nations and then the end shall come (Matthew 24:14).”

Consider translations of the Bible. In 1800 there were 71 in whole or in part. By 1930 that number had risen to 900. Today there are 2100 with 1900 more in progress.

Incidentally, those statistics are a little misleading because they leave the impression that many people still do not have a Bible in their language. The fact is that the existing translations cover over all the major languages of the world, representing more than 90% of the world’s population. The translations currently in progress are for tribal language spoken by 100 000 or less people.

In March, 1995 Billy Graham broadcast a gospel message from Puerto Rico that was carried by 37 satellites to 185 countries and territories in a total of 117 different languages! Over 1.5 billion people viewed the programme. It is estimated that more people heard that one sermon than had heard the Gospel since it was first proclaimed by the Apostle Peter 2 000 years ago!

With regard to world mission activity, I attended a mission conference in the mid-1990s where one of the key speakers told us that 70% of all mission work in history had been done since 1900, and 70% of that since 1945, and 70% of that since 1985 – all due, of course, to the implementation of modern technology.

The results have been overwhelming:

There were 10 million Christians in Africa in 1900. Today: 516 million.

There were 700 thousand Christians in China in 1949. Today: 70 million.

There were 50 000 Evangelical Christians in Latin America in 1900. Today: 60 million.

And, according to Muslim sources, everyday 16 000 Muslims convert to Christianity, for a total of 6 million per year!

Worldwide, the number of Christians has nearly quadrupled in the last 100 years, from about 600 million in 1910 to more than 2 billion in 2010, constituting one-third of the world’s population. The conversation rate is on the exponential curve:

1800, 100 per day

1900, 1000 per day

1950, 4000 per day

1980, 20 000 per day

1990, 86 000 per day

1995, 100 000 per day

2010, 175 000 per day

12. World Politics – The exponential curve also applies to world events. Habakkuk 1:5 is as relevant today as if it were written yesterday: “The Lord replied, ‘Look, and be amazed! You will be astounded at what I am about to do! For I am going to do something in your own lifetime that you have to see to believe.’”

I took a Sabbatical in 1987 and wrote a book called Trusting God. Seven years later, in 1994, I took another Sabbatical and completely rewrote that book. The exercise gave me an opportunity to reflect back over the seven years between the two Sabbaticals. I was astounded – even overwhelmed – by the rapid and stupendous nature of world event.

Who could have dreamed in 1987 that within the next seven years any of the following events would have occurred?

*The tearing down of the Berlin Wall.

*The peaceful liberation of Eastern Europe from Communism.

*The collapse of the Soviet Union.

*The reunification of Germany.

*The resurgence of Islam and its emergence as the greatest threat to world peace.

*The sending of 500 000 American troops to the other side of the world to defend a country most Americans have never heard of (Kuwait).

*The handshake between Rabin and Arafat that has led to Israel surrendering portions of its heartland to the PLO.

In 1987if you had predicted any of these developments, you would have been written off as “nuts.” The rapidity of these events and their radical nature is breathtaking. They underscore the possibility of the impossible. And they certainly reveal that man is not in control.

The Significance of the Curve

So, what does all this mean to you and me? I would mention three things.

First, the exponential curve is proof positive that Bible prophecy is true. The Lord has told us what He is going to do in the end times, and we had better pay attention to what He has said.

Second, the fulfillment of prophecy related to the exponential curve shows that God is in control. Even when it appears that everything on this earth is out of control, we can be assured that God is orchestrating all the chaos to the ultimate triumph of His Son in history (Psalm 2).

Third, the exponential curve is very strong evidence that we are living on borrowed time. It points to the fact that Jesus is at the very gates of Heaven, waiting for the command of His Father to return.

A Warning and an Illustration

I want to conclude by issuing a strong warning against taking time for granted. Many people are doing that today. They are saying, “I’m going to get serious about the Lord when I get out of school:” or “after I get a job;” or “after I’m established in my career;” or after I get married;” or “after I get my children raised.” Time is precious. There is very little left. Now is the time to get serious about the Lord. Let me illustrate how critical the timing is by returning to the exponential curve. Suppose you put one bacterium in a jar, and assume it doubles every second. How many bacteria do you think would exist in the jar at the end of 30 seconds? The answer, incredibly, is 1,073,741,824. That’s more than a billion in thirty seconds. That’s the ferocity of the exponential curve.

Now, let’s carry the illustration a step further. If at the end of 30 seconds the jar is half full, how much longer will it take for the jar to become full? The answer is one second (because it will double in the next second). That is the suddenness of the exponential curve.

That’s what the Bible means when it says that people will be saying, “Peace and Safety!” when “sudden destruction” will come upon them (1 Thessalonians 5:3).

A Call to Action

Are you taking time for granted? Don’t do it. The Exponential Curve is just one of many signs God is giving us to warn of the soon return of His Son. The Bible says that the only reason Jesus has not returned is because God does not wish that any should perish. 2 Peter 3:9 says: “The Lord is not slow about His promise, as some count slowness, but is patient toward you, not wishing for any to perish bur for all to come to repentance.”

In other words, the loving kindness of God has restrained Him from sending His Son back to this earth. But that restraint is soon coming to an end for our God is a God of justice, and as such, He must deal with the sinful rebellion of this world.

The signs of the times are shouting from the heavens that Jesus is returning soon to pour out the wrath of God on those who have rejected His love and grace. Are you ready for His return? Have you placed your faith in Jesus as your Lord and Saviour? Do you understand that God deals with sin in only one of two ways?

Consider John 3:36: “He who believes in the Son has eternal life; but he who does not obey the Son shall not see life, but the wrath of God abides on him.”

Are you under grace or wrath? God deals with sin in one of those two ways. It is a glorious thing to be under the grace of God. It is a dreadful thing to be subject to His wrath. Do not turn a deaf ear to the signs of the times. The time to act is now. If you are not a Christian, then reach out in faith and receive Jesus as your Lord and Saviour. If you have already done that, then commit your life to holiness and evangelism.

Samevatting

Internasionaal het daar nie veel veranderings, soos verlede maand gerapporteer, plaasgevind nie. Waar daar wel veranderings was, het dit gekom van inligting rakende die onderskeie lande se “Purchasing Manager Indices”. Dit dui daarop dat in die vervaardigingsektore sake besig is om in baie lande verder te verlangsaam. Dan wil dit voorkom asof die nuus uit Sjina nie té belowend is nie. Die groeikoers in ons terme gemeet is steeds heel belowend naamlik sowat 7,5%. Daar is egter kommer oor skuldvlakke by banke en prysstygings van woonhuise. Gevolglik kan daar nie vanaf monetêre kant vraagstimulasie maatreёls in werking gestel word nie. Dit laat ‘n mate van onsekerheid dat die groeikoers dalk verder kan verlangsaam.

In die VSA is daar ook kommer oor die volhoubaarheid van die matige tempo van ekonomiese opswaai. In Euroland en die VK bly sakestoestande steeds bedruk en dit wil selfs voorkom asof Duitsland nou ook swakker groeivoortuitsigte tegemoetgaan.

Sover dit plaaslike verwikkelinge betref, wil mens byna sê ditto. Ook hier is die groeitempo onderliggend aan die verlangsaam. Maar dan is daar boonop probleme eie aan die RSA soos die jongste gebeure by die myne. Verder gaan die land se inwoners nie die gevolge van oorbesteding, wat die afgelope aantal jare voorgekom het, vryspring nie. In hierdie oorsig sal aan hierdie sake aandag gegee word, aangevul deur die jongste verwikkelinge op ekonomies/finansiёle gebied. Die pryse van aandele op die JSB, met die uitsondering van pryse van mynaandele, bly egter stewig. Op die oog af lyk dit na ‘n teenstrydigheid met wat in die ekonomie plaasvind. Ek reken dat daar egter sekere verwagtinge begin intree by beleggers wat dié optrede kan verklaar.

Verloop van ekonomiese groei

Die Sentrale Statistiekdiens het die afgelope maand die BBP syfers vir kw2:2012 vrygestel.

Jaar-op-jaar beskou, het die reёle BBP redelik stewig vertoon na ‘n effens swakker groeisyfer in kw1. In kw2 vanjaar was die groeikoers 3,0% hoёr as verlede jaar volgende op ‘n styging van 2,1% in kw1. Sou na die BBP se verloop van kwartaal-tot-kwartaal gekyk word, seisoenaal aangepas en teen ‘n jaarkoers bereken, het dit van 2,7% in kw1 tot 3,2% in kw2 verbeter.

Met eerste oog opslag lyk dit na ‘n merkbare verbetering wat ingetree het, ten spyte van swak internasionale omstandighede wat uitvoere nadelig raak. Kom ons beskou die saak egter bietjie van naderby.

In die eerste kwartaal vanjaar het die groeikoers verswak hoofsaaklik gedryf deur ‘n swak vertoning van mynbou weens stakings by Impala en produksieverliese by van die ander myne. Dit het tot gevolg gehad dat k-t-k gemeet, mynbouproduksie op die vorige kwartaal teen ‘n jaarkoers gemeet, met 16,8% gedaal het. Sou die vertoning van mynwese buite rekening gelaat word, blyk dit dat die res van die ekonomie met 3,8% gestyg het teenoor die totale BBP syfer van 2,7%.

Indien dieselfde oefening vir kw2 gedoen word, naamlik om mynbou buite rekening te laat, word gevind dat die groeisyfer vir die ander sektore van 3,8% in kw 1 tot 1,6% in kw2 verlangsaam het. Die mynbousektor wat in kw2 met 31,2% van k-t-k verbeter het, het die totale syfer sodanig verwring dat dit op die oog af wil voorkom asof die ekonomiese groeikoers aan die versnel is. Inderwaarheid, is die teendeel besig om te gebeur.

Dit is nie verbasend dat die groeikoers onderliggend verlangsaam nie, want soos in verlede maand se oorsig reeds op gewys is, het elektrisiteitsverkope in kw2 swak vertoon; het uitvoervolumes gedaal terwyl invoer in reёle terme steeds sterk gestyg het. Dit beteken maar bloot dat invoer toenemend binnelandse vraag, wat terloops redelik stewig bly, bevredig. Dit is natuurlik negatief vir die BBP groeikoers. Meer nog, soos ook op gewys is, het uitvoerpryse swak vertoon sodat die ruilvoet verswak het. Daarby neem netto faktorbetalings aan die buiteland steeds toe, sodat die bruto nasionale inkome selfs nog swakker as die BBP vertoon. Bevestiging van hierdie neigings sal in die komende maand deur die Reserwebank in hulle kwartaaloorsig, bekend gemaak word.

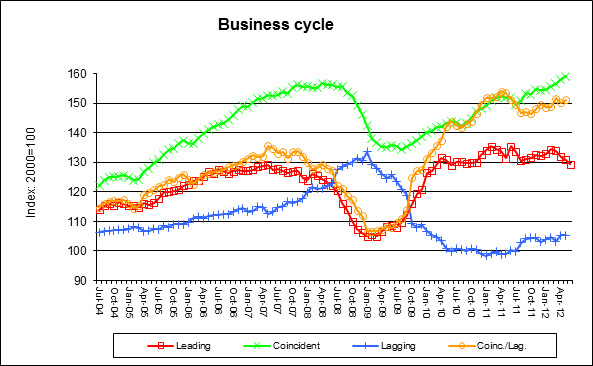

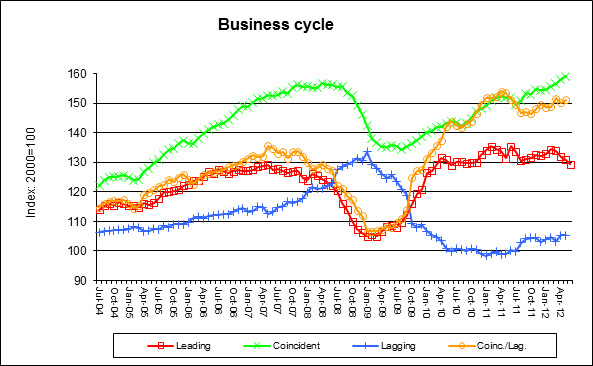

Dat die ekonomiese groeikoers onderliggend swakker neig en verder verwag word om swakker te vertoon, word bevestig deur die verloop van die leidende aanwyser van die sakesiklus.

Soos blyk uit voorgaande grafiek, neig die leidende aanwyser tot Junie vanjaar reeds vir 4 maande laer. Daar kan dus aanvaar word dat die ekonomiese groeikoers in komende maande verder kan verlangsaam alhoewel die meevallende aanwyser tot en met Mei, dit nog nie bevestig het nie. Daar is vir die derde kwartaal nog baie min inligting beskikbaar. Soos dit algaande bekend gemaak word, sal dit wel aandui waarheen sake neig. In volgende maand se oorsig, sal die prentjie hieroor meer duidelik wees.

Inflasie

Die inflasiekoers soos gemeet aan hand van die VPI vir die land as geheel, toon sedert die begin van die jaar, ‘n geleidelik verlangsaming in die koerstoename. Dit het van 6,4% in Januarie tot 5,0% in Julie verlangsaam. Die grootste daling was te wyte aan ‘n verlangsaming in die koerstoename van voedselprodukte wat van 10,2% in Januarie tot 5,3% in Julie afgeneem het. Die kerninflasiekoers, d w s die totaal min voedsel, het dan ook heelwat stadiger gedaal en wel van 5,4% tot 4,8%. Hierby aansluitend, moet in gedagte gehou word dat die inflasiekoers verlede jaar oor dieselfde tydperk, vanaf 3,6% tot 5,4% versnel het. Vanjaar word dit dus gemeet teen ‘n stygende basis.

Aangesien dit egter voedselpryse was wat die toon in die huidge daling aangegee het, moet lesers daarvan kennis neem dat dié tendens waarskynlik nie sal voortduur nie. Die rede, soos verlede maand genoem, is dat graanpryse internasionaal op die termynmarkte, die afgelope tyd baie skerp gestyg het. Die gevolg hiervan is dat voedselpryse in die PPI, wat in die prysketting VPI pryse vooruitloop, in Julie reeds skerp begin styg het. Die prys van landbouprodukte soos opgeneem in die PPI, het in Julie met 5,4% teenoor Junie gestyg en dit was 9,0% hoёr as ‘n jaar tevore. Die prys van graanprodukte, het in Julie met 7,9% toegeneem en was 27,6% hoёr as ‘n jaar tevore. Oliesade se prysstygings het 38% beloop vergeleke met ‘n jaar tevore.

Voeg hierby die prysstygings van elektrisiteit wat op PPI vlak 14,5% hoёr as ‘n jaar gelede was. So ook die verswakking in die gemiddelde waarde van die wisselkoers van 11% teenoor verlede jaar. Voeg hierby die skerp verhoging in die prys van vloeibare brandstowwe vanaf 5 September vanjaar. Daar is ook ‘n sterk moontlikheid dat die arbeidskoste per eenheid produksie gelewer, kan toeneem. Dit wil dus voorkom asof die maandelikse styging in die inflasie indeks in komende maande kan versnel. Dit word egter steeds gemeet teen ‘n versnelde basis wat verlede jaar sy hoogtepunt in Desember bereik het. Dit kan die stygingstempo dalk temper maar beswaarlik in toom hou.

Voorgaande gebeure kan in die komende maande dus daartoe lei dat reёle rentekoerse kan daal. Dit kan binnelandse vraag ondersteun, aangevul deur ‘n fiskale beleid wat steeds sterk vraagstimulerend is. Dit, op sy beurt, kan invoer hoog hou, terwyl uitvoer verder kan verswak. Hoe buitelandse beleggers hierop gaan reageer, moet nog gesien word. Die internasionale kredietgraderingshuise het egter geluide begin maak dat die land se internasionale kredietgradering verlaag kan word. Dit alles kan tot ‘n swakker wisselkoers aanleiding gee wat die groeipoging kan ondersteun omdat uitvoere meer mededingend raak en daar beter met invoer meegeding kan word. Dit sal egter nie goeie nuus vir die inflasiekoers wees nie. Dit sou ook kon beteken dat verdere rentekoersdalings buite die kwessie is.

Finansiёle markte

Die afgelope tyd het kapitaalmarkrentekoerse skerp gedaal. Dit kan toegeskryf word aan buitelanders wat effekte op groot skaal aangekoop het. Vir die eerste agt maande van die jaar beloop dit nou reeds sowat R70 miljard op ‘n netto basis beskou. Die rede hiervoor, is die verskil in nominale rentekoerse wat bestaan. Gegewe die verwikkelinge soos tot dusver bespreek en veral as die land se internasionale kredietwaardigheid verlaag sou word, kan dié aankope tot ‘n einde kom.

Aandelebeurse in Westerse lande het die afgelope maand redelik goed vertoon – veral die in Duitsland, Frankryk en in Japan. Die Dax sowel as die Cac het in die tydperk 27 Julie tot 31 Augustus met 4,2% gestyg, die Nikkei met 3,2% en die Ftse met 1,5%. Die Dow se styging was ‘n beskeie 0,1% terwyl die S&P-500 met 1,5% en die Nasdaq met 3,7% toegeneem het. Die vertoning van beurspryse in veral Europa is heel insiggewend. Dit moet onthou word dat markte verwagtinge vooruit verdiskonteer. Nou kan daar ‘n paar redes vir die verbetering in beurspryse wees. Het pryse dalk te ver gedaal die afgelope jaar sodat beleggers gemaklik voel met die huidge waardasies? Of, reken beleggers dat die ergste gevolge weens aanpassings in Euro-lande dalk nou verby kan wees? Of, verwag hulle verdere vraag stimulerende maatreёls wat binnekort dalk aangekondig kan word? Of, is die resutlaat die gevolg van al drie genoemde faktore? Wat verder insiggewend is, is dat die euro in die ses weke tot einde Augustus met 3,6% in waarde teenoor die VSA$ gestyg het.

Plaaslik het die beurs die afgelope maand ook verstewig en gemiddeld met 2,1% gestyg. Hulpbronaandele het aanvanklik redelik skerp met sowat 5% verbeter maar in die laaste drie weke, toe die nuus bekend geword het dat Sjina se groeikoers dalk swakker kan wees, het dit byna al die vorige prysstygings prysgegee.

As daar gekyk word na die prys/verdienste verhouding van die totale beurs asook van die hoof indekse, dan blyk dit dat die beurs gemeet teen historiese vlakke, gemiddeld geprys is maar dat hulpbronaandele goedkoop lyk. Dalk is daar ‘n rede hiervoor naamlik dat die verwagtings is dat winste van hulpbronmaatskappye nog onder aansienlike afwaartse druk kan kom.

A J Jacobs

2012-09-04